Sustainability.

Gore Street Capital builds and operates renewable energy solutions that support the transition to a cleaner, cheaper and more secure energy system.

Our sustainability mission.

We believe that climate change is one of the biggest threats to our collective future. Gore Street Capital was founded to support the fight against climate change by providing the infrastructure needed to phase out fossil fuels and integrate more renewable energy sources, such as wind and solar, into the grid. It’s our mission to be a leader in creating and implementing green energy sustainability practices to accelerate the transition to a more sustainable world.

Our aim.

It’s our mission to be a leader in creating and implementing green energy sustainability practices to accelerate the transition to a more sustainable world. Our values guide us in achieving our mission. They are part of our DNA and define how we engage with each other, our partners, and our stakeholders. Embedding these principles in our daily work helps us become a more responsible renewable energy company, employer, and corporate citizen.

-

Invest in transformative energy systems.

-

Acquire, build & manage high-performing assets with discipline.

-

Work in an open, collaborative, dynamic and inclusive environment.

-

Be ambitious in our role in energy transition.

Our approach.

Our teams actively monitor and align health and safety initiatives, other ESG criteria, and investment objectives throughout the key stages of an acquisition, through construction, and operational phases. By considering ESG factors, we support our overarching goal of supporting the transition toward a more sustainable energy system.

1. Asset identification and assessment

The investment team actively evaluates potential ESG-related exclusions during investment assessments and regularly conducts market analyses for each grid network under review. We work with advisors to evaluate the policy landscape, regulatory environment, and location-specific climate-related risks such as flooding. We’ve built a robust network of project developers with expertise in early-stage development, ensuring that identified projects meet or will meet land, planning, and grid energisation requirements by the time of acquisition.

2. Acquisition execution and onboarding of new assets/projects

We oversee the acquisition process from bid to close, leveraging third parties to ensure unbiased due diligence. Our commercial team facilitates onboarding new assets by vetting route-to-market partners and collaborating with the technical team on implementation, commissioning tests, and revenue access.

3. Procurement and construction

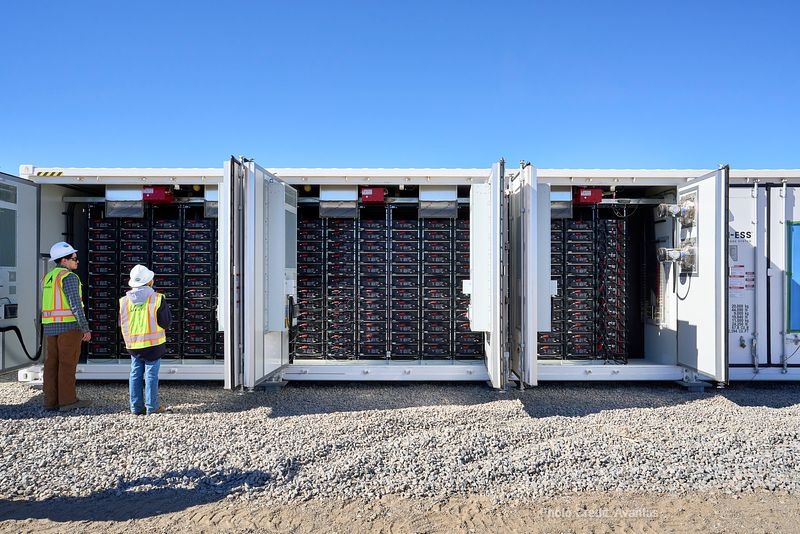

Our in-house construction team negotiates key contracts from project engineering, construction to obtaining warranties for continued battery performance. The construction and procurement team are responsible for monitoring project buildout, including holding relevant stakeholders accountable for cost, quality control, and timeline management.

4. Performance optimisation, responsible management and monitoring

Our in-house asset management team are responsible for managing relationships with stakeholders, monitoring technical performance and maximising availability of assets to deliver revenue. We prefer remote monitoring and maintenance services over site visits, because it minimises the need to travel and reduces our carbon footprint.

Measurable outcomes.

We view environmental, social and governance (ESG) factors as more than a set of numbers. They are a critical tool for evaluating and improving the relationships with our staff, business partners, communities, and the natural world.

The assets under our management play a crucial role in decarbonising the grid systems in which they operate. We track a number of metrics to help quantify the benefits of these systems, including net CO2 emissions avoided and total renewable electricity stored.

The latest ESG & Sustainability Report for our client Gore Street Energy Storage Fund can be found here.

We will continue to keep up to date with new methodologies and industry best practices to ensure we deliver the best possible ESG services to our clients.

Diversity, equity and inclusion.

We believe in the importance of creating a working environment in which everyone can thrive. As part of our commitment to diversity, we have implemented a number of policies designed to promote gender equality, and we offer hybrid working to suit our team’s needs. Our HR policies and initiatives are informed by an annual survey, which provides valuable feedback to help us create and maintain a supportive workplace in which everyone feels respected and valued.

Diversity is not just the right thing to do – it is also paramount for advancing the green energy transition, which requires new skills, collaboration, and innovative thinking to build a power system fit for the future. By bringing together people from different backgrounds, experiences and cultures, we believe we can best serve our clients, who currently own energy storage systems across three different continents.

As of March 2025, we had:

This diversity boosts our performance by incorporating a broad range of perspectives into our business. Since this diversity isn’t always present in the wider energy sector, we proactively collaborate with various stakeholders to advance inclusion and promote diverse viewpoints

Charitable support.

We believe it’s our responsibility as corporate citizens to build positive relationships with the communities that are located near our offices, our clients’ assets and our wider supply chain. We’re proud to work with a number of organisations that serve these communities and are aligned with our mission of building a more sustainable world. Our contributions to charitable causes include corporate donations as well as fundraising team challenges and volunteering days.

See the latest charitable causes Gore Street Capital has supported:

The Impact Facility

The Impact Facility is one of the founding members of the Fair Cobalt Alliance, a multi-stakeholder platform supporting cobalt mining communities in the DRC, of which our client, Gore Street Energy Storage Fund, is a member. GSC’s donation supports the implementation of responsible production practices and professionalisation of the sector, which is essential for accelerating the deployment of clean energy technologies such as battery energy storage.

UNICEF

The impacts of climate change disproportionally affect many poorer communities in developing regions. It is, therefore, important to support the efforts of organisations that facilitate communities’ access to essential infrastructure and resources, such as clean water. The company’s donation, matched by personal contributions, helped fund the installation of a water system in Nampula province which is expected to supply water to more than 9,000 people.

War Child

As armed conflicts increase in severity around the world, War Child’s mission to ensure a safe future for every child living through war is more important than ever. A team of runners took to London’s streets to run a five km course alongside thousands of others from the city’s corporate community to support the charity’s teams working around the world providing children with life-saving medical and psychological care. After matching its own employees’ donations, Gore Street Capital was able to raise over £8,500 to help make a difference to thousands of children whose lives have been turned upside-down by conflict.

These funds marked the second year the company has provided support to War Child after a donation was made in November 2022 at the Annual Winter Wassail Dinner for Children in Conflict.

Ace of Clubs

Ace of Clubs is a London-based charity that serves those in the community experiencing homelessness. These services include providing food, laundry, healthcare, clothing, and welfare advice. Ace of Club’s holistic approach and strong track record have ensured their integration into the community, allowing them to help a diverse range of people.

The Children's Book Project

It is estimated that one in three disadvantaged children across the UK has fewer than ten books of their own at home, and one in ten has none. These disparities have a direct correlation and impact outcomes later in life. The Children’s Book Project aims to tackle book poverty and increase opportunities for children to read and thereby improve literacy by gifting over 500,000 books across the country.

The Conservation Volunteers

In 2024, His Majesty King Charles III became a Royal Patron because of their extensive work improving biodiversity in spaces ranging from local nature reserves, community gardens and sites of special scientific interest to school grounds, hospitals and waterways. Research has proven the numerous positive impacts green spaces can have on people’s physical and mental health and wellbeing, as well as helping to develop stronger communities on top of the environmental benefits.