What we do.

The Gore Street Capital team brings together a wide range of skills and knowledge. We are financial professionals, engineers, project managers, and thought leaders who work together to create value for our clients.

Our funds.

GS Energy Storage Fund

Gore Street Energy Storage Fund plc (“GSF”) is London’s first listed energy storage fund, launched in 2018. GSF is the only UK-listed energy storage fund with a diversified portfolio across five grid networks. GSF aims to provide investors with a sustainable and attractive dividend, generated from long-term investment in a diversified portfolio of utility-scale energy storage assets. The Fund is an evergreen vehicle and is listed as an Article 8 Fund under the EU Sustainable Finance Disclosure Regulation (SFDR).

For more information, visit the GSF website: Sustainability and Impact is part of our DNA

GS Japan

Gore Street, in partnership with the ITOCHU Corporation (“ITOCHU”), was selected to be the manager of Japan’s first fund (“GS Japan”) dedicated to grid-scale energy storage systems, the “Tokyo Energy Storage Investment Limited Partnership”. A joint venture company was established with ITOCHU as the fund’s general partner in early 2024. The fund primarily focuses on the Kanto region, home to approximately one-third of Japan’s population, and leverages Gore Street’s market entry experience. The positive business case for storage in Japan is centred around 20-year fixed-price contracts. However, the merchant business model in Japan has the potential to unlock significant upside and result in higher returns, making it an attractive opportunity. The fund is a private, 10-year vehicle.

Our expertise.

We are a team of financial professionals, engineers, project managers, and thought leaders working together to deliver measurable returns, optimise project outcomes, and drive innovative solutions for our clients.

Our investment professionals have extensive international experience originating, underwriting, closing, monitoring, and exiting investments in funds operating within the firm’s target sectors. Combining their expertise with extensive networks and market insight, the team secures high-quality, consistent deal flow and executes assets with precision through a disciplined investment approach.

Gore Street Capital are experts in:

-

Sourcing disruptive technologies in the energy sector.

-

Developing renewable energy infrastructure project and managing assets.

-

Designing and managing strategic deals in a challenging policy environment.

-

Forming strategic partnerships and working with multiple public and private sector stakeholders in the development of large and complex projects.

-

Energy markets and trading.

Our services.

Delivering value through expertise

From the outset, we led the deployment of privately owned grid-scale battery projects in Great Britain and have since applied our expertise globally. We’ve established a presence across six energy markets by leveraging our diverse teams’ technical and financial expertise to provide clients with the core services essential for success in clean energy investments.

Investment

Our investment professionals have a proven track record of sourcing, structuring, and managing acquisitions of large renewable energy solutions globally. We’ve vetted hundreds of projects, securing only the best opportunities for our clients. This requires regular market analyses of each target grid network, in collaboration with local advisors, to assess the relevant regulatory environment for each grid operator.

We’ve built a robust network of project developers with expertise in early-stage development, ensuring that investment-ready projects meet all necessary requirements by the time of acquisition.

The team handles the entire acquisition process, from bid to close, and manages project risks for each client, utilising third parties for due diligence and to eliminate biases in assessing opportunities.

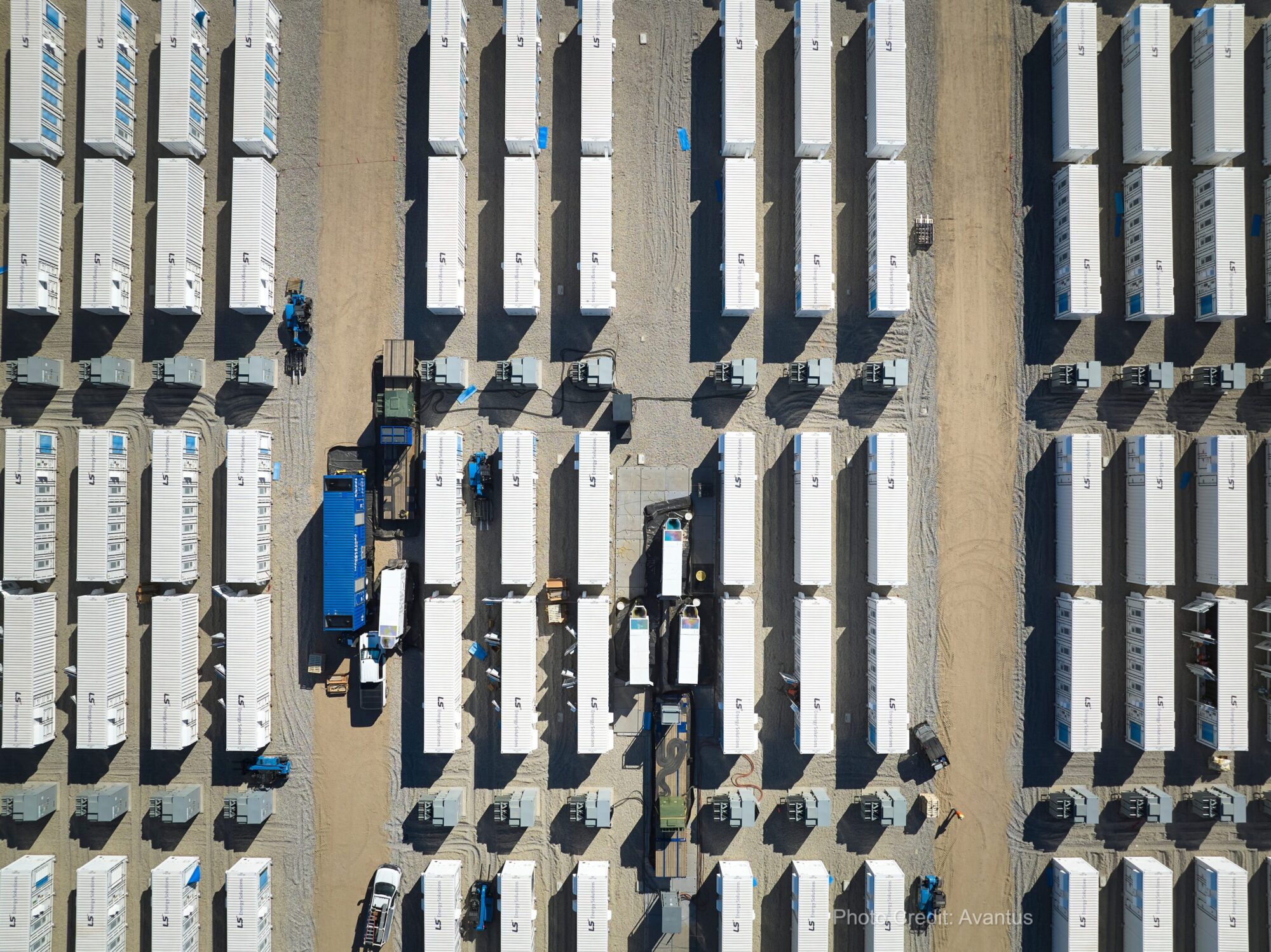

Procurement and Construction

Successful owners of renewable energy infrastructure assets need to be informed and understand the technical nature of the assets they hold. We provide that expertise through a unique understanding of the financial drivers of investment in renewable energy and extensive experience in bringing together the full spread of manufacturers and contractors required to effectively deliver renewable infrastructure projects.

Gore Street’s procurement and construction team is made up of technical professionals with an established track record of success in delivering renewable energy solutions around the world. They are responsible for implementing successful progress across each phase of a project from early-stage development, sale and acquisition, pre-construction and construction, operation and decommissioning or end of life activity.

Where developers focus on the front end of a project and contractors deliver during construction, we deliver a holistic programme of procurement and construction centred on operational resilience and long-lasting capability. This ensures every asset under Gore Street’s management is built at the best value to deliver the highest possible returns for our clients.

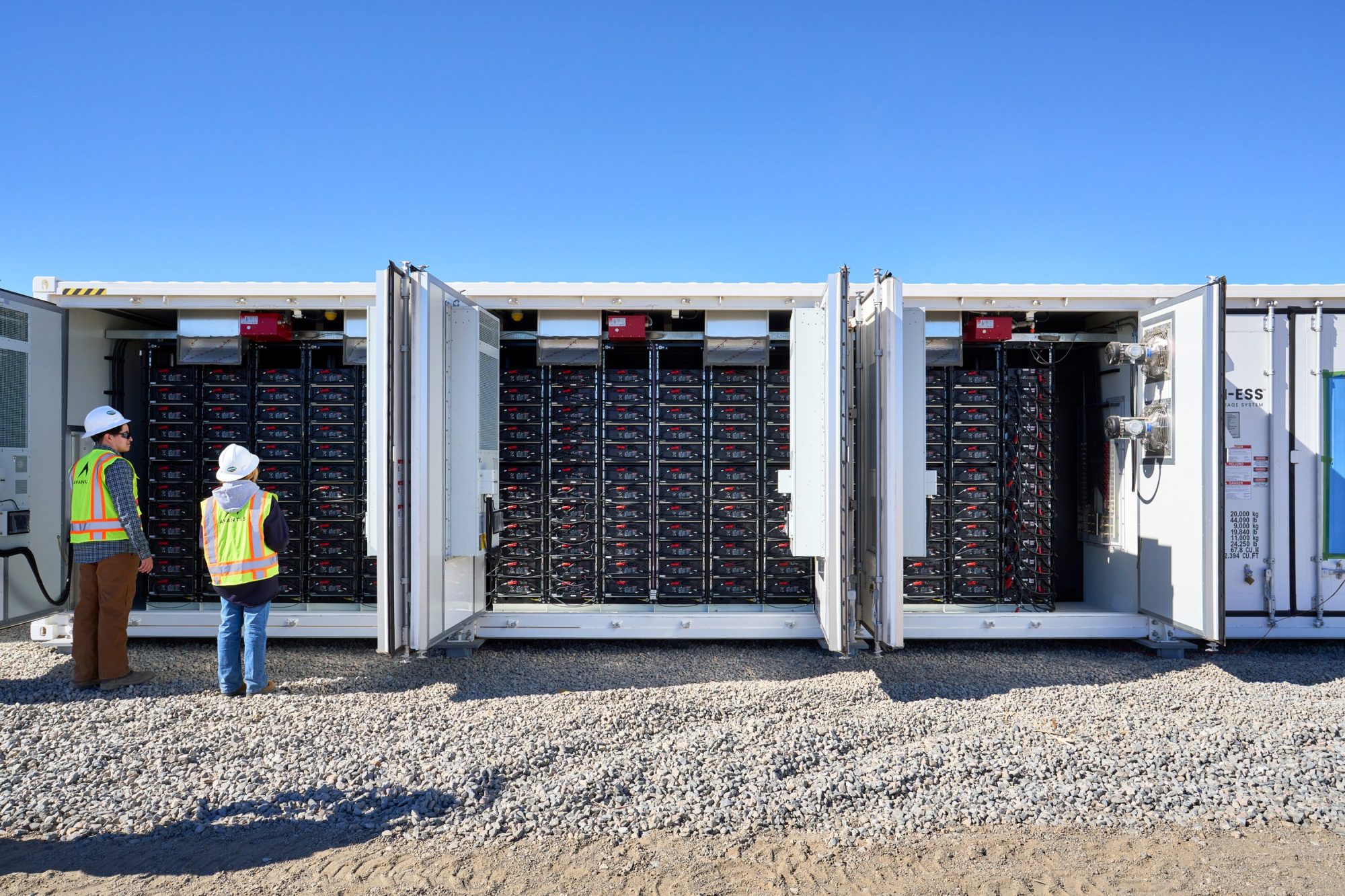

Asset Management

Our asset management team maximises asset value and performance by ensuring constant availability and minimising downtime. Using advanced monitoring and proactive maintenance, we keep assets running at peak efficiency, fulfilling revenue contracts and delivering the consistent performance our clients expect.

We use cutting-edge technology to track performance at the component level, enabling precise analysis of operational data. This active approach enhances efficiency, implements preventative maintenance, and swiftly addresses safety issues, minimising downtime and maximising revenue opportunities. Our asset management strategy integrates health, safety, and environmental objectives with financial performance. This holistic approach boosts asset resilience and sustainability whilst aligning with client and community expectations.

Commercial

Our commercial team delivers exceptional value to clients through its unparalleled international expertise. With a managed portfolio of c.1.27 GW, spread across five markets, we’ve pioneered innovative approaches to revenue optimisation and generation within the clean energy investment space. The team excels by designing tailored strategies for each distinct market. We dive into local energy dynamics, regulatory details, and existing contracts to create sophisticated bidding approaches that boost our clients’ revenue. Our in-house expertise enables us to apply insights from one region to refine operations in another, seamlessly transferring knowledge and optimising results across markets.

Optimisation & Trading

Our in-house trading desk complements the comprehensive services we offer to our clients. With an interdisciplinary team boasting over 15 years of experience, we employ a data-driven, hands-on approach designed to optimise revenue generation for each asset on our book, all while adhering to asset warranties and limitations.